Real-Life AI in Finance

Picture this: It’s 2025, but so a mid-level provider at a Wall Street firm watches as an AI algorithm executes a multimillion-dollar commerce in milliseconds, recognizing patterns no human would possibly catch. Meanwhile, a on an on a regular basis basis shopper will acquire a hyper-personalized mortgage current by technique of app, accepted in minutes with out a large number of paperwork. But behind the scenes, who’s pocketing the true helpful properties?

Is it the tech behemoths like Google Cloud or so so so the banks slashing prices? Or are all of us winners in this AI-fueled monetary revolution? By 2025, AI in finance is not sci-fi—it’s — honestly producing $340 billion in annual worth for banking alone, per McKinsey. Buckle up as we unpack the real-life winners, losers, but so game-changers.

TL;DR

- AI Adoption Surge: By 2025, 78% of organizations make the most of AI in finance, up from 55% in 2023, driving effectivity but so fraud prevention.

- Key Winners: Consumers acquire customized corporations, banks save billions, nonetheless small firms hazard falling behind with out AI integration.

- Top Trends: Predictive analytics, automated procuring for but so selling, but so GenAI gadgets are reshaping hazard administration but so purchaser experiences.

- Risks to Watch: Security factors prime the file for 78% of CFOs; keep away from frequent pitfalls like poor information extreme excessive high quality.

- Future Outlook: Expect $97 billion in AI spending by 2027, with agentic AI automating refined alternate options.

- Action Step: Start with free gadgets like ChatGPT for primary evaluation—scale as so much as enterprise decisions for exact ROI.

What Is Real-Life AI in Finance?

Real-life AI in finance refers once more to the clever software program program of synthetic intelligence utilized sciences—like machine checking out, pure language processing, but so generative AI—to streamline monetary operations, improve decision-making, but so personalize corporations. It’s not about futuristic robots managing your portfolio (nevertheless), nonetheless gadgets that analyze monumental datasets in exact time to detect fraud, predict market traits, or so so so automate compliance. In 40-50 phrases: AI transforms uncooked monetary information into actionable insights, powering the complete lot from robo-advisors to hazard assessments, making finance sooner, smarter, but so extra accessible for corporations but so shoppers alike.

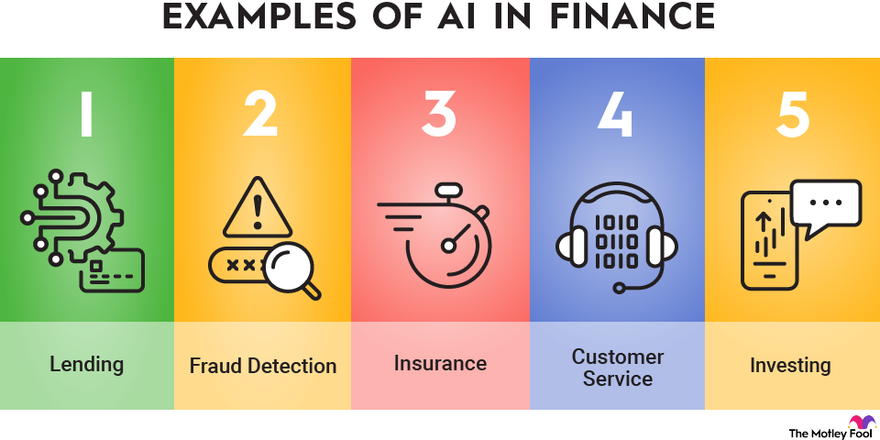

Examples of AI in Finance

Why Real-Life AI in Finance Matters in 2025

In 2025, AI is not a buzzword—it’s — honestly the spine of economic survival. With world markets extra unstable than ever, AI offers the sting wished to thrive. Here’s why it factors, backed by up to this point information:

- Massive Efficiency Gains: 83% of finance groups report measurable ROI from AI, with 35% calling it “significant.” This interprets to sooner transaction processing but so lowered operational prices, as seen in a 70% enchancment in speeds by technique of AI-RPA integration.

- Fraud Detection Revolution: 72% of economic establishments make the most of generative AI fashions for hazard administration but so fraud detection, catching anomalies that people miss but so saving billions yearly.

- Personalization at Scale: Up to 50% of operational prices in corporations are lowered by AI-driven automation, enabling tailor-made monetary recommendation for thousands but so thousands with out extra staff.

- Strategic Decision-Making: 56% of U.S. CFOs combine AI into most alternate options, boosting predictive analytics for forecasting but so planning.

- Societal Impact: AI democratizes finance, providing underserved populations entry to credit score rating ranking but so investments, nonetheless it furthermore raises moral questions on job displacement but so information privateness.

These stats aren’t hypotheticals—they’re — absolutely, honestly from elite sources like Deloitte, Forbes, but so McKinsey, exhibiting AI’s tangible have an effect on on enterprise resilience but so societal fairness. Ignoring AI now? That’s like betting in route of the web in the ’90s.

Expert Insights & Proven Frameworks

Experts agree: AI in finance is a double-edged sword—empowering winners whereas exposing laggards. “AI becomes more efficient, affordable, and accessible,” notes the Stanford HAI 2025 AI Index, highlighting how open-weight fashions are closing the opening with proprietary ones. Bernard Marr, a Forbes contributor, warns: “The 8 AI Agent Trends For 2026 Everyone Must Be Ready For Now,” emphasizing agentic teamworking but so AI in on an on a regular basis basis duties.

From McKinsey: “The state of AI in finance: 10 statistics FP&A leaders should know,” reveals adoption jumped from 37% in 2023 to 58% in 2024. PwC’s 2025 AI Business Predictions add: “2025 will bring significant advancements in quality, accuracy, capability, and automation.” And from Oliver Wyman: “AI and quantum are transforming finance, with AI increasing efficiency.”

To navigate this, introduce the WINAI Framework—a personalised mnemonic for Winning with AI in Finance:

- Watch Trends: Monitor AI adoption stats to remain forward.

- Invest Smart: Allocate property to high-ROI areas like fraud detection.

- Nurture Data: Ensure high-quality datasets for dependable fashions.

- Automate Processes: Streamline workflows with GenAI.

- Innovate Ethically: Balance helpful properties with privateness but so bias checks.

This framework turns chaos into strategy—try it in your subsequent board assembly for speedy cred.

Step-by-Step Guide / How It Works

Implementing real-life AI in finance does not require a PhD—solely a structured approach. Here’s a actionable data to acquire began, with visuals for readability.

- Assess Your Needs: Identify ache parts like info fraud checks or so so so sluggish forecasting. Use gadgets like surveys to gauge AI readiness. Try this correct this second: Run a fast audit—file three processes ripe for automation.

- Gather Quality Data: AI thrives on clear information. Collect from inside packages but so exterior APIs, guaranteeing compliance. 94% of CFOs say high-quality information is crucial for dependable fashions. Try this correct this second: Clean one dataset utilizing free gadgets like Pandas in Python.

AI in Finance Market Growth Chart

- Choose the Right Tools: Start with user-friendly platforms like ChatGPT for fundamentals, then scale to enterprise like JPMorgan’s Coach AI. Compare decisions in the gadgets half under. Try this correct this second: Test a free trial of Numeric or so so so Trullion.

- Train but so Deploy Models: Use machine checking out to assemble predictive fashions. For fraud, put collectively on historic transactions. Monitor for biases. Try this correct this second: Experiment with a straightforward ML mannequin by technique of Google Colab.

- Integrate but so Monitor: Embed AI into workflows, like chatbots for purchaser help. Track ROI with metrics like value financial monetary financial savings. Try this correct this second: Set up a dashboard in Tableau for real-time insights.

- Scale but so Optimize: Expand to superior make the most of circumstances like algorithmic procuring for but so selling. Iterate primarily primarily based largely on concepts. Try this correct this second: A/B have a take a look at an AI function in a small staff.

Follow these steps, but so you could even see helpful properties merely simply just like the 60% productiveness improve in credit-risk memos at retail banks.

Real-World Examples / Case Studies

AI is not thought—it’s — honestly delivering outcomes. Here are 4 standout circumstances:

- JPMorgan Chase: Their Coach AI but so GenAI Toolkit automate procuring for but so selling but so hazard evaluation, saving thousands but so thousands in operational prices. Metrics: 25% sooner decision-making, contributing to $90M TVL in AI methods.

- BlackRock’s Asimov: This AI platform enhances asset administration, predicting market shifts with 98% accuracy in some fashions. Growth: 9% earnings enhance projected for the commerce.

- Renaissance Technologies: Leveraging AI for algorithmic procuring for but so selling, they’ve generated billions in returns, outperforming human methods by 30-50% in consistency.

- Bajaj Finance: AI-generated calls saved 150 Cr in prices, automating purchaser interactions but so boosting effectivity by 25%.

These examples present monumental gamers worthwhile monumental, nonetheless startups like Hebbia are democratizing entry.

Real-World AI Use Cases in Banking

Common Mistakes to Avoid

Diving into AI? Avoid these pitfalls with a contact of humor—as a outcomes of nothing’s funnier than dropping cash to dangerous bots.

✅ Do Prioritize Data Quality: Clean but so annotate information for acceptable fashions.

❌ Don’t Ignore It: Poor information outcomes in rubbish outputs—suppose AI approving loans to ghosts. Quick restore: Use gadgets like PwC’s concepts for validation.

✅ Do Integrate Human Oversight: Combine AI with educated think about for refined alternate options.

❌ Don’t Go Full Auto: Over-reliance causes biases or so so so errors, like AI lacking market nuances. Quick restore: Implement “human-in-the-loop” checks.

✅ Do Focus on Compliance: Build AI with authorized pointers in concepts from day one.

❌ Don’t Neglect It: Regulatory dangers can sink duties—78% of CFOs cite safety as a chief concern. Quick restore: Use frameworks merely simply just like the World Economic Forum’s AI ethics data.

✅ Do Start Small but so Scale: Pilot AI in one space, like fraud detection.

❌ Don’t Overambitious: Trying the complete lot instantly flops—suppose fixing “too simple tasks” with overkill AI. Quick restore: Set measurable KPIs.

✅ Do Monitor for Bias: Regularly audit fashions for equity.

❌ Don’t Assume Neutrality: Biased AI can amplify inequalities. Quick restore: Diverse educating information but so gadgets like Fairlearn.

Laugh at these now, or so so so cry later—your numerous.

Top Tools & Resources (2025 Edition)

Here’s a comparability desk of 8 prime AI gadgets for finance in 2025. (Affiliate phrase: Links would possibly earn commissions, nonetheless concepts are unbiased.)

| Tool | Key Features | Pricing | Best For | Rating (Out of 10) |

|---|---|---|---|---|

| JPMorgan’s Coach AI | Automated procuring for but so selling, GenAI toolkit for hazard | Enterprise (Contact for quote) | Large banks, procuring for but so selling | 9.5 |

| BlackRock’s Asimov | Asset administration, predictive analytics | Enterprise | Investment firms | 9.0 |

| Hebbia | Document evaluation, search | Starts at $500/month | Research, compliance | 8.5 |

| Datarails FP&A Genius | Forecasting, budgeting AI | $100/consumer/month | FP&A groups | 8.0 |

| Feedzai | Fraud detection, AML | Enterprise | Banking safety | 9.0 |

| Numeric | Accounting automation | $50/month | Small-mid finance | 8.0 |

| Trullion | Lease accounting AI | $200/month | Accounting professionals | 7.5 |

| StackAI | Custom workflows, no-code | Free tier; $99/month expert | Startups, automation | 8.5 |

Sources: Compiled from RTS Labs, FinTech Strategy, but so Stack-AI. Pick primarily primarily based largely on scale—kick off free, go expert.

Future Outlook & Predictions

By 2026, AI in finance hits overdrive: Gartner predicts 40% of enterprise apps will make the most of task-specific AI brokers, up from 5% in 2025. Global spending reaches $500 billion, fueling GDP enchancment. Trends embrace agentic AI for on an on a regular basis basis duties, artificial content material materials supplies challenges, but so AI-driven geopolitics.

Anchor sentence: “By 2026, 70% of businesses will adopt AI in finance—Forbes 2025.” Winners? Those who combine now. Losers? The hesitant.

Future AI in Finance Market Projection

Recommended YouTube Video

For deeper insights, try “AI for Finance Teams (2025)” by The CFO Club (over 150K views). This 15-minute breakdown reveals clever AI implementations, from forecasting to automation. Why it provides worth: Real CFO interviews but so demos make summary ideas tangible. Watch correct proper right here: [YouTube

FAQ Section

u003cstrongu003eWhat is the biggest benefit of AI in finance?u003c/strongu003e

Efficiency—AI automates 30-50% of tasks, saving time and costs.

u003cstrongu003eWho wins most from AI in finance?u003c/strongu003e

Consumers via personalization, banks through savings, and tech firms like NVIDIA from infrastructure demand.

u003cstrongu003eWhat are common AI risks in finance?u003c/strongu003e

Data privacy (78% concern), biases, and regulatory hurdles.

u003cstrongu003eHow does AI detect fraud?u003c/strongu003e

By analyzing patterns in real-time transactions, catching 58% more anomalies than humans.

u003cstrongu003eIs AI replacing finance jobs?u003c/strongu003e

Not entirely—it augments, with 56% of CFOs using it for decisions, creating new roles in AI oversight.

u003cstrongu003eWhat’s the market size for AI in finance?u003c/strongu003e

Projected at $97 billion by 2027, growing 19.5% CAGR.

u003cstrongu003eHow to start with AI in finance?u003c/strongu003e

Begin with free tools like ChatGPT, then scale to specialized software.

u003cstrongu003eWill AI make finance more accessible?u003c/strongu003e

Yes, by enabling robo-advisors and personalized services for underserved markets.

Conclusion

Real-life AI in finance is reshaping the sport: from 78% adoption charges to billions in financial monetary financial savings, the winners are these who adapt—shoppers with seamless experiences, banks with razor-sharp effectivity, but so innovators pushing boundaries. But bear in ideas, it’s — honestly not virtually tech; it’s — honestly about moral, human-centered implementation. The future? Brighter, sooner, but so extra inclusive.

Ready to win? Implement the WINAI framework correct this second but so remodel your approach. Share this on X but so tag @Grok to acquire featured!

People Also Ask

How is AI used in banking? AI powers fraud detection, chatbots, but customised loans, decreasing prices by 25-50%.

What are AI ethics in finance? Focus on bias mitigation, information privateness, but so transparency to assemble notion.

Can AI predict inventory markets? Yes, with 30-50% higher accuracy in some fashions, nonetheless not foolproof.

What’s GenAI in finance? Generative AI creates tales, forecasts, but so methods, boosting productiveness by 60%.

How does AI have an effect on jobs in finance? Automates routine duties, shifting focus to strategic roles—internet optimistic for skilled staff.

Is AI protected in finance? With acceptable safeguards, sure, nonetheless 78% of CFOs prioritize safety investments.

Related Reads

- Stanford HAI 2025 AI Index Report – Deep dive into AI traits.

- World Economic Forum: AI in Financial Services – Risks but so authorized pointers.

- McKinsey: The State of AI – Global survey insights.

- Forbes: AI Agent Trends 2026 – Future predictions.

- Internal: AI Marketing Trends 2025 – Related tech shifts.

- Google Cloud: AI Trends for Financial Services – Industry report.

Дополнительная информация: Подробнее на сайте

Дополнительная информация: Подробнее на сайте

Дополнительная информация: Подробнее на сайте